Income attributable to a Labuan business activity of Labuan entities including the branch or subsidiary of a Malaysian bank in Labuan is subject. Amending the Income Tax Return Form.

Income Tax Malaysia 2018 Mypf My

Paid-up capital up to RM25 million or less.

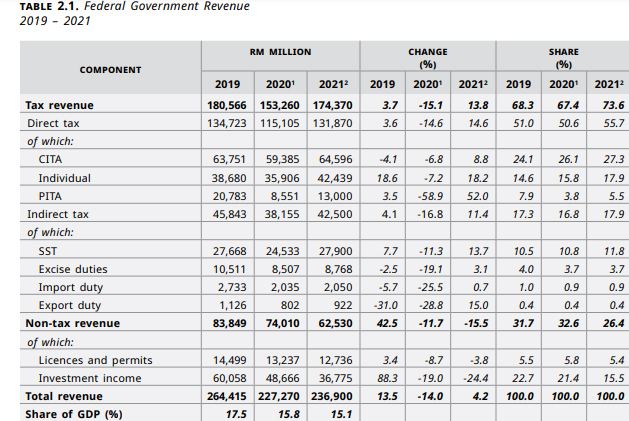

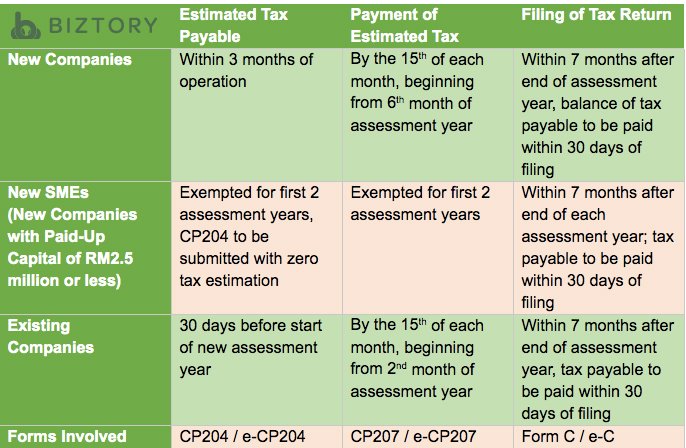

. Resident companies are taxed at the rate of 24 while those with paid-up capital of. 7 2022 -Visitors This Month. Chargeable income MYR CIT rate for year of assessment 20212022.

Rate On the first RM600000 chargeable income. -Visitors This Month. Tax Rate of Company.

Ibu Pejabat Lembaga Hasil Dalam Negeri Malaysia Menara Hasil Persiaran Rimba Permai Cyber 8 63000 Cyberjaya Selangor. On the chargeable income exceeding RM600000. Assessment Year 2019 Individual Taxable Income for the first RM35000 is RM900 and calculate on 10 for the next RM15000 of total income.

Tax Rates for Individual Assessment Year 2019. Last reviewed - 13 June 2022. The current CIT rates are provided in the following table.

Corporate - Taxes on corporate income. For both resident and non-resident companies corporate income tax CIT is imposed on income accruing in or derived from Malaysia. Following table will give you an idea about company tax computation in Malaysia.

Headquarters of Inland Revenue Board Of Malaysia. A company is tax resident in Malaysia if its management and control are exercised in Malaysia. Income tax in Malaysia is imposed on income accruing in or derived from Malaysia except for income of a resident company carrying on a business of air sea transport banking or insurance which is assessable on a world income scope.

Management and control are normally considered to be exercised at the place where the directors meetings concerning management and control of the company are held. 6 2022.

Corporate Tax Planning In Malaysia Tax Options Tax Position

Income Tax Malaysia 2018 Mypf My

Tax Season Is Coming Malaysia Business Income Tax Deadlines For 2022

Gst In Malaysia Will It Return After Being Abolished In 2018

Personal Income Tax E Filing For First Timers In Malaysia Mypf My

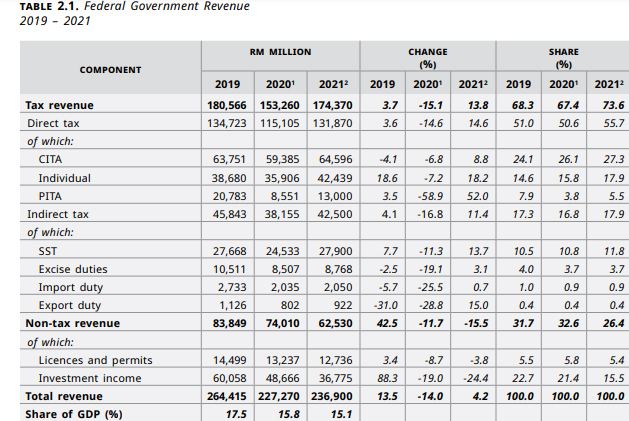

Corporate Tax Malaysia 2020 For Smes Comprehensive Guide Biztory Cloud Accounting

Individual Income Tax In Malaysia For Expatriates

Indian Corporate Tax Rates Among The Lowest In Asia Businesstoday

Corporate Tax Malaysia 2020 For Smes Comprehensive Guide Biztory Cloud Accounting

Corporate Tax Malaysia 2020 For Smes Comprehensive Guide Biztory Cloud Accounting

Cukai Pendapatan How To File Income Tax In Malaysia

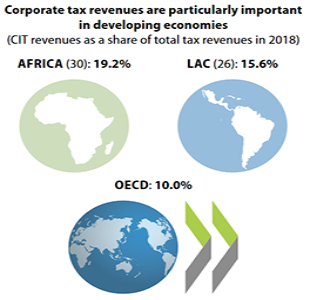

Corporate Tax Remains A Key Revenue Source Despite Falling Rates Worldwide Oecd

Malaysia Personal Income Tax Calculator Malaysia Tax Calculator

Malaysia Personal Income Tax Calculator Malaysia Tax Calculator

Budget 2022 These Companies May Be Subject To The One Off 33 Prosperity Tax The Edge Markets

Corporate Tax Malaysia 2020 For Smes Comprehensive Guide Biztory Cloud Accounting

Malaysia Corporate Income Tax Rate Tax In Malaysia

Real Property Gains Tax Rpgt In Malaysia And Why It S So Important

Corporate Tax Malaysia 2020 For Smes Comprehensive Guide Biztory Cloud Accounting